A well-prepared and well-presented cost report can provide valuable insights to the stakeholders, such as the project manager, the client, the sponsor, the accountant, and the auditor. In this section, we will discuss some of the best practices for preparing and presenting a cost report, as well as some of the common challenges and pitfalls to avoid. We will also suggest some of the next steps that can be taken after completing a cost report, such as reviewing the lessons learned, implementing the corrective actions, and celebrating the achievements. Cost reporting is a vital process for any project or business that involves managing and tracking expenses.

How much are you saving for retirement each month?

The data should also be categorized and classified according to the cost elements, such as direct costs, indirect costs, fixed costs, variable costs, and overhead costs. From a financial perspective, analyzing cost data helps in assessing the overall financial health of a business. By examining cost trends over time, financial analysts can identify cost drivers, such as changes in raw material prices or labor costs, and evaluate their impact on the company’s financial performance. This analysis enables stakeholders to make informed decisions regarding investments, budgeting, and resource allocation. Before collecting any cost data, it is essential to clarify the scope and purpose of the cost report. This will help to determine what type of cost data is needed, how much detail is required, and what time period is covered.

6: Preparing a Production Cost Report

And some of the relevant cost subcategories may be excavation, concrete, steel, wood, tiles, pipes, wires, etc. These metrics help to measure the progress, efficiency, and effectiveness restaurant accounting of the cost management and control. For example, a positive CV indicates that the project is under budget, while a negative CV indicates that the project is over budget.

What is a Production Cost Report?

Notice that each section of thisreport corresponds with one of the four steps described earlier. Weprovide references to the following illustrations so you can reviewthe detail supporting calculations. Following is a complete cost of production report that accounts for all the Balloon department’s units and costs. The cost report should be reviewed and revised before submitting or presenting it to the stakeholders.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Review problem 8.5

- Heightened oil supply security concerns are set against a backdrop of a global market that – as we have been highlighting for some time – looks adequately supplied.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- A cost of production report is a document used by manufacturers to calculate the cost of producing goods during a specific period.

- In this section, we will discuss some of the common cost report metrics, how to interpret them from different point of views, and how to use them to make informed decisions.

Finally, we’ll add links to free project management templates to help manufacturers deliver on time and within budget. From the accounting records, we see that total direct materials transferred to the mixing department in February were $3,575 and that direct labor and manufacturing overhead totaled $3,640. We have 4,000 total units for which to account, with 750 in process at the beginning of the month, and the last batch that is still in process at the end of the month will be 1,000 shells once it is done.

It is important to identify the relevant cost categories and subcategories that are applicable to the project, program, or activity being reported. This will help to organize and classify the cost data in a consistent and logical manner. For example, if the cost report is for a construction project, then some of the relevant cost categories may be site preparation, foundation, framing, roofing, plumbing, electrical, etc.

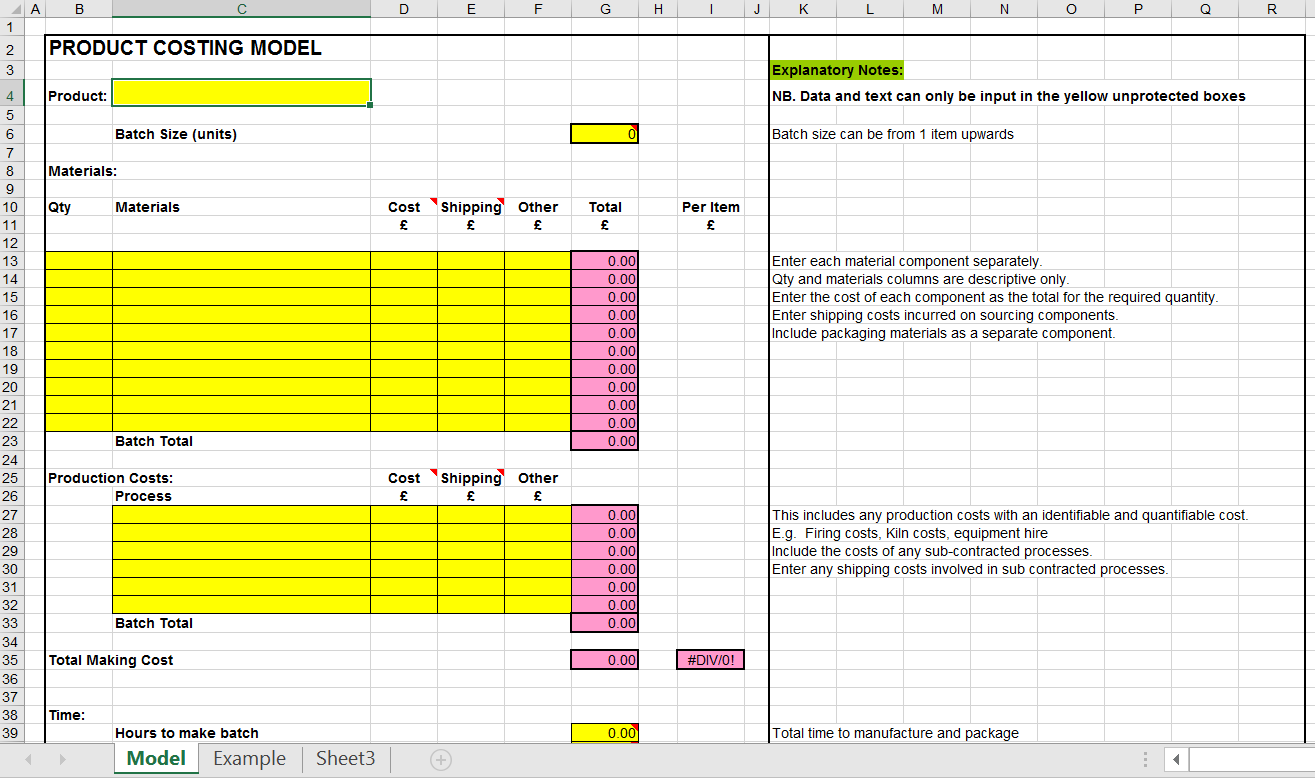

An example of how to use Excel to prepare aproduction cost report follows. Notice that the basic data are atthe top of the spreadsheet, and the rest of the report is driven byformulas. Each month, the data at the top are changed to reflectthe current month’s activity, and the production cost report takescare of itself.